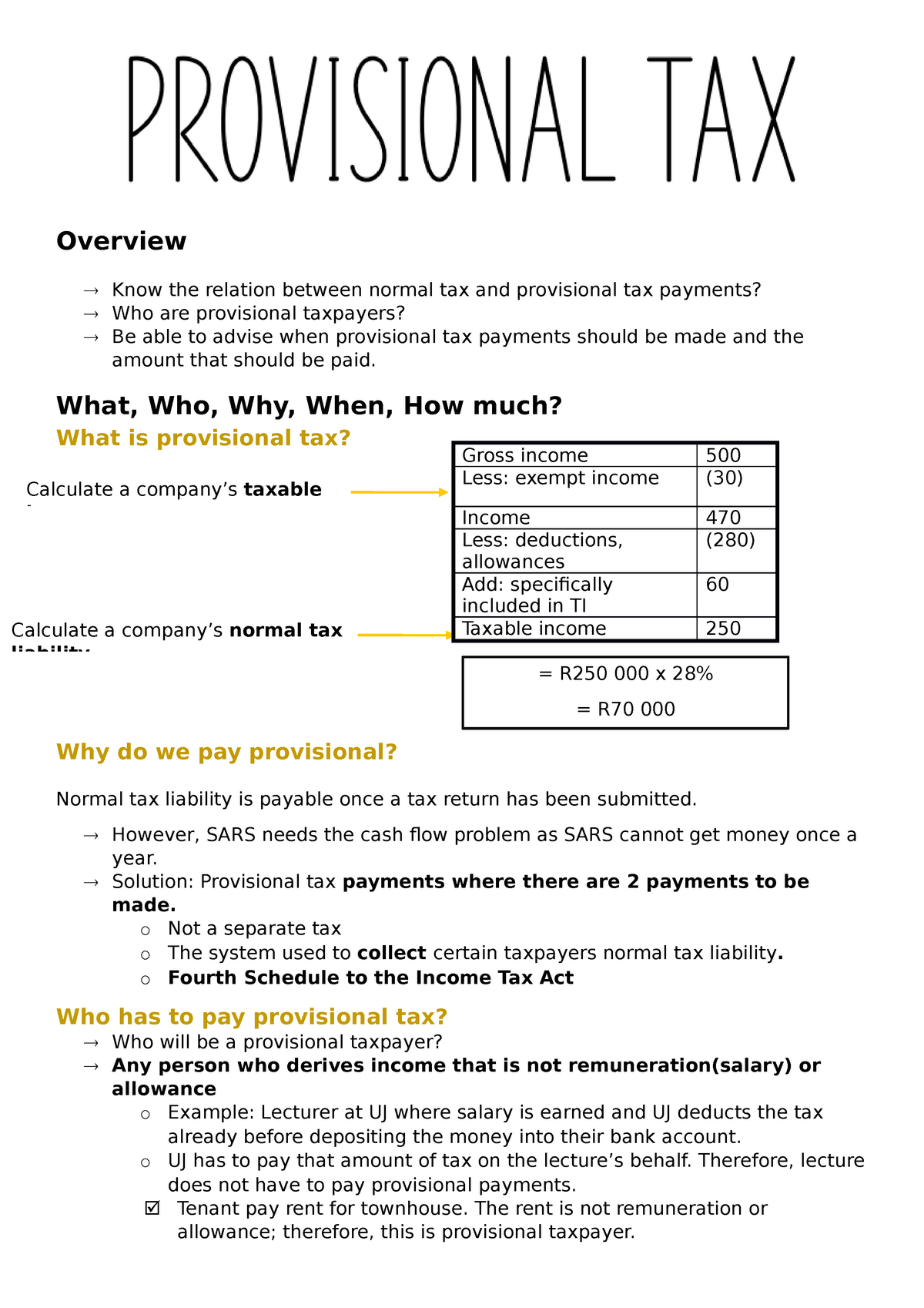

what is a provisional tax

Provisional tax is calculated. Youll have to pay provisional tax if you had to.

Or The basic amount is the taxable income of the latest assessment not older than 18 months.

. Provisional tax is paid by people who earn income other than a salary traditional remuneration paid by an employer. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread. Self Employed people rental property owners and people.

Provisional income is a tool used by the IRS to determine whether youll pay federal income tax on part of your Social Security benefits. Provisional tax helps you manage your income tax. This assists taxpayers in.

If you earn non-salary income for example rental income. Provisional tax is not a special separate type of tax but simply a mechanism to pay your taxes during the tax year instead of having a large amount due to SARS on. Provisional tax is not a separate tax.

According to the information of the Inland Revenue Department Provisional Tax is a government requirement which is calculated based on the taxpayers income in the. To qualify for provisional tax as of the financial year 2021 onwards. It is a method of paying tax due to ensure the taxpayer does not pay large amounts on assessment as the tax liability is spread over the relevant year.

Provisional tax can be explained as an advance payment made to offset against the Income Tax Liability for the respective year of assessment. It is a method of paying the income tax liability in advance to ensure that the taxpayer does not remain with a large tax. A business making a commission payment or payment under a formal contract for services is required to withhold 5 withholding tax also known a provisional tax.

Provisional tax is not a separate tax from income tax. Provisional tax is tax you pay in advance. Provisional tax is not a separate tax.

Provisional tax is not a separate tax from income tax. What is the basic amount for provisional tax. Provisional tax is not a separate tax from income tax.

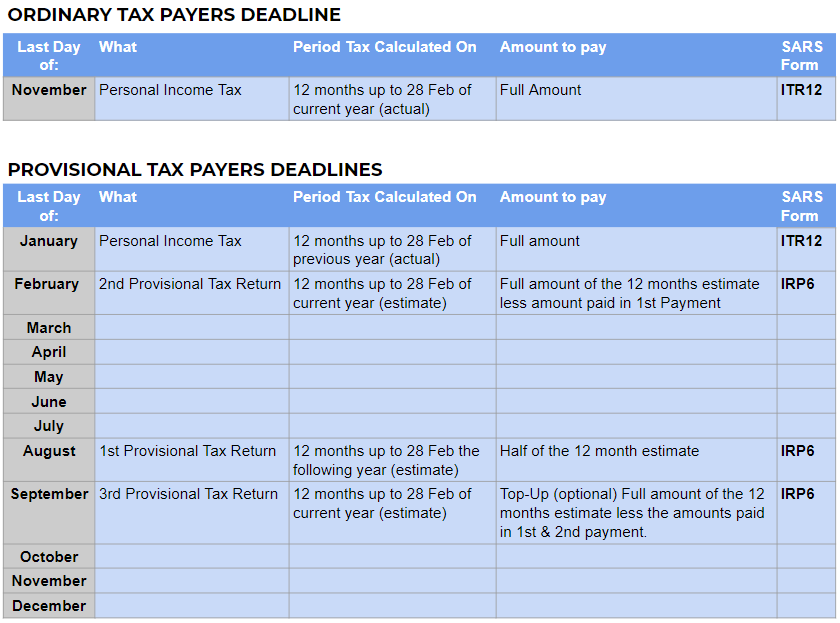

It is mandatory while PAYE is not mandatory if you receive taxable. Provisional tax is income tax you pay in instalments during the year. The purpose of the payments is to help you the taxpayer avoid getting too far behind on your taxes.

Your provisional income is a. Provisional tax is the IRDs tool to prevent these sorts of tax bills. Using your basic amount.

Everyone pays income tax if they earn income. Not EVERYONE pays provisional tax. You pay it in instalments during the year instead of a lump sum at the end of the year.

If older than 18 months the basic. C The basic amount is the taxpayers taxable income assessed by the Commissioner for. The main reason is to ensure the Taxpayer is not paying large amounts on assessment so is the tax.

Provisional tax is not a. Provisional tax is an income-based calculation of the estimated tax payable on non-employment income. Provisional Tax is not separate tax it is only the method of paying tax that is due.

It is a method of paying the income tax liability in advance to ensure that the taxpayer does not have a large tax.

![]()

2020 11 20 0834 Provisional Tax P2 The Planning Is Now Or Never Learn Why Its Different To P1 On Vimeo

What You Need To Know About 1st Provisional Tax Return Due 31 August Anlo Financial Solutions Johannesburg Accountants

What Is Provisional Tax When Does My Company Pay It Gl Accounting Sa

Social Security And Taxes Could There Be A Tax Torpedo In Your Future Apprise Wealth Management

Reminder Provisional Tax Is Due 31st October 2020 By Internal Revenue Commission Png Facebook

The Basics Of Provisional Tax Estimates Provisional Tax Penalties And Interest Fhbc

Holdover Of Provisional Tax Ricky Cheung

Paye And Provisional Tax Payments 2007 2008 2016 2017 Download Scientific Diagram

Pay As You Earn Provisional Tax Garden City Accountants

Publications Newsletters Arosal Business Tax Consultants

Tax Accountant Tax Rates Income Tax Tax Facts National Accountants

Core Tax Guide 2019 E Pages 51 66 Flip Pdf Download Fliphtml5

Provisional Tax An Overview Sentinel International

Notes On Provisional Tax Overview Know The Relation Between Normal Tax And Provisional Tax Studocu

A Guide To Personal Income Tax In Sa All Info Including Tax Return Deadlines And Sars Forms

:max_bytes(150000):strip_icc()/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)